Empowering SMBs with Compliance Automation

Small and medium-sized businesses (SMBs) face an uphill battle in navigating complex regulatory landscapes. Unlike large enterprises with dedicated compliance teams, SMBs often struggle with limited resources, time constraints, and evolving security threats. Regulatory frameworks like SOC 2, HIPAA, NIST, and ISO 27001 require continuous monitoring, policy enforcement, and audit readiness—tasks that can be overwhelming for a lean team.

Risk Cognizance is here to change that. As a user-friendly, automated compliance solution, it empowers SMBs to meet regulatory requirements efficiently, reduce risk exposure, and strengthen security postures without the burden of manual compliance management.

The Power of Automated Compliance for SMBs

Gone are the days of spreadsheets and reactive compliance approaches. Risk Cognizance simplifies compliance through automation, offering a seamless, integrated, and intelligent compliance management system tailored for SMBs. Whether tracking regulatory changes, managing security questionnaires, or identifying third-party risks, our platform ensures compliance is always one step ahead.

Why SMBs Need Automated Compliance

1. Regulatory Complexity is Growing

As cybersecurity threats evolve, regulations become stricter. SMBs must comply with standards such as PCI-DSS, GDPR, CMMC, and SOC 2 to maintain business relationships and avoid penalties. Risk Cognizance automates compliance tracking, ensuring businesses meet requirements without manual intervention.

2. SMBs Are Prime Cyber Attack Targets

SMBs lack the security budgets of large enterprises, making them vulnerable to cyber threats. Risk Cognizance integrates AI-driven threat intelligence to monitor risks related to DNS, SSL, Dark Web, Network, and Application security, providing real-time alerts and automated remediation.

3. Manual Compliance Management is Costly and Inefficient

Compliance traditionally requires dedicated personnel, third-party consultants, and extensive documentation. Risk Cognizance reduces operational costs by automating security assessments, policy management, and risk evaluations—freeing up valuable resources for business growth.

How Risk Cognizance Empowers SMBs

1. Automated Policy and Control Mapping

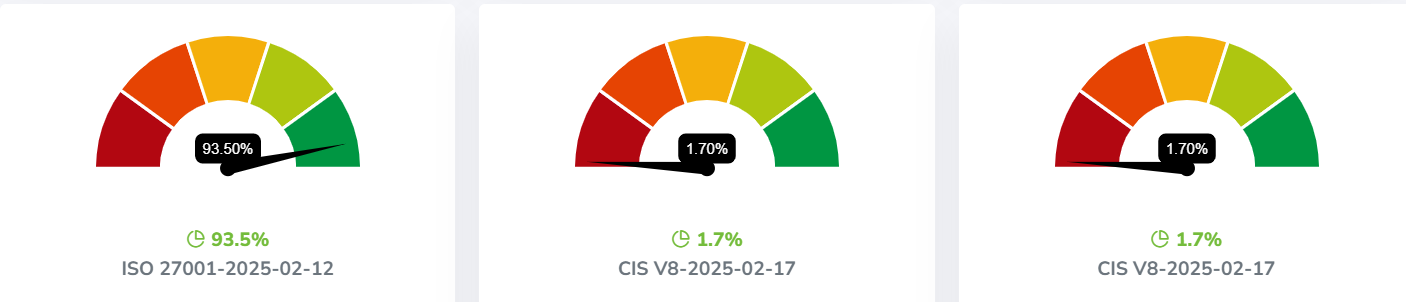

Say goodbye to tedious policy mapping. Risk Cognizance syncs security policies with frameworks like NIST, ISO 27001, and HIPAA, ensuring automatic updates and reducing human error.

2. Seamless Security Questionnaire Automation

Security questionnaires are often roadblocks in vendor assessments and business partnerships. Risk Cognizance pre-fills responses, aligns them with compliance frameworks, and provides AI-backed recommendations, significantly reducing turnaround time.

3. Built-In Threat Intelligence for Proactive Risk Management

Risk Cognizance includes six integrated threat intelligence tools:

- DNS Threat Intelligence – Identifies malicious domains and phishing attempts.

- SSL Certificate Monitoring – Detects expired or misconfigured certificates.

- Dark Web Surveillance – Monitors leaked credentials and compromised assets.

- Network Threat Intelligence – Evaluates exposed ports and IP reputation.

- Application Security Monitoring – Identifies software vulnerabilities and API risks.

- Third-Party Risk Analysis – Continuously assesses vendor security posture.

4. AI-Driven Risk Syncing and Continuous Compliance

Traditional compliance audits happen once a year. Risk Cognizance ensures real-time risk syncing, allowing SMBs to maintain continuous compliance through AI-driven monitoring and automated remediation.

5. Over 250 Integrations for a Unified Compliance Ecosystem

Risk Cognizance connects seamlessly with Tenable, Qualys, AWS Security Hub, Google Cloud Secure Center, Azure Governance Center, and more—providing SMBs with an all-in-one compliance solution.

Transforming Compliance From Burden to Business Advantage

With Risk Cognizance, compliance shifts from a liability to a competitive advantage. SMBs can confidently meet regulatory requirements, enhance customer trust, and mitigate security risks—all while focusing on business growth.

Ready to automate compliance and protect your business? Contact us today to get started with Risk Cognizance!

.jpg)