Complete Guide to Risk Acceptance

Risk acceptance is a critical aspect of risk management, allowing organizations to acknowledge certain risks while maintaining operational efficiency. Without a structured approach, businesses may face unforeseen consequences, including financial loss and reputational damage.

Imagine a mid-sized enterprise facing a compliance challenge. Traditional methods involve excessive manual tracking, leading to inefficiencies and errors. Now, picture an automated compliance solution that simplifies risk acceptance, ensuring informed decision-making. This is where Risk Cognizance AI Automated Compliance Software excels.

Why is Risk Acceptance Important?

Risk acceptance is a strategic decision to acknowledge certain risks rather than mitigate them completely. Businesses accept risks when:

- The cost of mitigation exceeds potential damages.

- The risk impact is minimal and manageable.

- Compliance frameworks allow for controlled risk-taking.

- Industry best practices support calculated acceptance.

With Risk Cognizance, organizations gain the ability to track, assess, and document accepted risks seamlessly.

How Risk Acceptance Enhances Compliance Strategy

A well-defined risk acceptance strategy ensures that businesses can prioritize efforts where they matter most. The benefits include:

- Improved Decision-Making: Understand which risks are worth accepting and which require mitigation.

- Regulatory Compliance: Maintain compliance while managing risk exposure.

- Efficiency & Cost Savings: Reduce unnecessary compliance costs by focusing on critical risks.

- Automated Tracking: Keep a digital record of risk acceptance policies and decisions.

Risk Cognizance simplifies this process, providing a centralized platform where risk acceptance becomes an integral part of compliance management.

How to Implement a Risk Acceptance Framework

A structured risk acceptance framework ensures that businesses remain compliant while making informed choices. Key steps include:

- Identify Risks: Assess potential compliance and operational risks.

- Evaluate Impact: Determine the level of risk tolerance and potential consequences.

- Document Decisions: Keep track of accepted risks with detailed records.

- Monitor & Review: Regularly reassess accepted risks to ensure continued compliance.

Risk Cognizance offers AI-powered risk assessment tools, automated reporting, and real-time insights, making risk acceptance a seamless and user-friendly experience.

Risk Cognizance: The Ultimate Risk Acceptance Solution

Risk Cognizance AI Automated Compliance Software is designed to help businesses manage risk acceptance effortlessly. It provides:

- Comprehensive Risk Assessments to evaluate and categorize risks effectively.

- Automated Compliance Tracking for maintaining regulatory adherence.

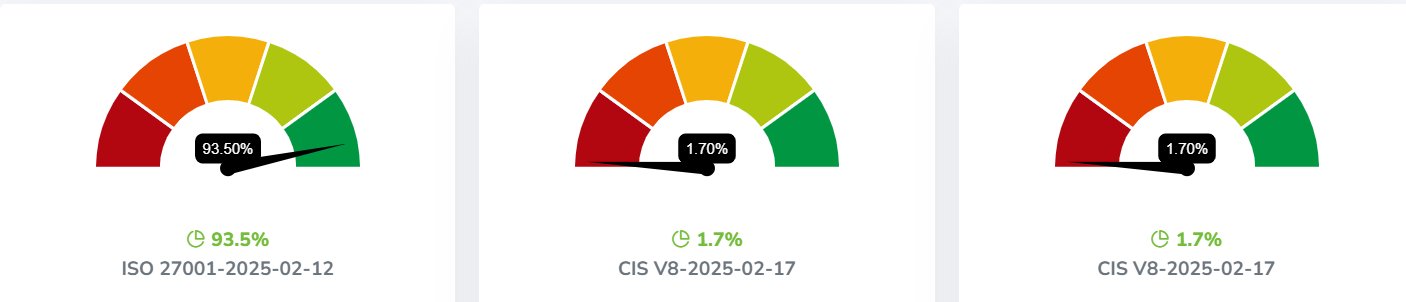

- User-Friendly Dashboards offering real-time risk monitoring.

- Seamless Documentation to ensure audit readiness and accountability.

With Risk Cognizance, businesses can confidently accept and manage risks without the fear of non-compliance. Its AI-driven automation ensures accuracy, efficiency, and ease of use, making compliance management simpler than ever.

Embrace a smarter approach to risk acceptance with Risk Cognizance – where compliance meets innovation.