CIOs and CISOs Grapple with DORA: Key Challenges, Compliance Complexities

Why Risk Cognizance is the Best Solution for DORA

Understanding the Difficulties with DORA Compliance

The Digital Operational Resilience Act (DORA) is a groundbreaking regulation aimed at enhancing the operational resilience of financial institutions, ICT service providers, and third-party vendors. However, CIOs and CISOs face significant challenges in aligning their compliance, risk management, and cybersecurity strategies with DORA’s stringent requirements.

1. Complex ICT Risk Management Requirements

DORA mandates a comprehensive risk management framework that integrates continuous security monitoring, system-wide risk assessments, and proactive incident response. Many organizations lack automated tools to ensure real-time visibility into ICT risks.

2. Stricter Incident Reporting Standards

Under DORA, firms must report ICT-related incidents within tight deadlines and provide structured reports to regulators. Manual reporting is inefficient, often leading to delays, errors, and compliance failures.

3. Vendor and Third-Party Risk Oversight

DORA enforces strict third-party risk management, requiring companies to continuously monitor and assess vendor compliance. Many firms struggle with vendor risk assessments, as traditional methods lack automation and real-time insights.

4. Ongoing Operational Resilience Testing

DORA mandates regular resilience testing, including penetration tests, scenario analysis, and risk simulations. Organizations without AI-driven risk modeling tools often fail to meet these requirements efficiently.

5. Regulatory Complexity and Resource Constraints

DORA introduces complex compliance mandates that require significant financial and personnel resources. Small and mid-sized firms lack dedicated compliance teams, making it difficult to implement robust governance frameworks.

How Does DORA Affect Financial Firms?

DORA introduces new operational resilience requirements that directly impact financial institutions, including banks, insurance companies, and investment firms.

1. Increased Accountability for Cybersecurity Risks

Financial firms must now demonstrate strong cybersecurity governance to regulators. This includes proactive risk assessments, real-time monitoring, and incident response protocols. Firms without automated GRC solutions struggle to meet these demands.

2. Enhanced Third-Party Risk Oversight

Financial institutions rely heavily on external ICT service providers for cloud computing, payment processing, and data management. DORA requires continuous monitoring of third-party risks, ensuring that vendors adhere to the same resilience standards as financial firms.

3. Stricter Incident Response and Recovery Protocols

DORA enforces rapid incident reporting, requiring financial institutions to report major cybersecurity incidents within hours. Firms without automated reporting tools face delays, compliance risks, and potential regulatory penalties.

4. Regulatory Pressure and Compliance Costs

Meeting DORA’s stringent operational resilience requirements demands significant financial and human resources. Many firms lack the infrastructure to manage compliance efficiently, leading them to seek AI-driven compliance solutions.

Small Businesses Also Look to Solve DORA with Risk Cognizance GRC Software

While large financial firms have dedicated compliance teams, small businesses are also heavily impacted by DORA’s regulatory requirements. SMEs must ensure operational resilience, protect sensitive data, and monitor third-party risks, all while managing limited resources.

1. Affordable Compliance for Small Businesses

Risk Cognizance provides a cost-effective GRC solution that allows SMEs to automate compliance processes without hiring large compliance teams.

2. AI-Powered Risk Assessments for SMEs

- Small businesses benefit from automated risk identification and mitigation

- Real-time threat intelligence helps SMEs proactively address compliance risks

3. Simplified Vendor Risk Management

- Ensures small businesses can continuously monitor third-party vendors

- Automates compliance assessments for ICT service providers

4. Streamlined Incident Reporting & Response

- Helps SMEs meet DORA’s strict incident reporting deadlines

- Automates forensic analysis and post-incident documentation

5. Scalable & Easy-to-Use GRC Platform

- Designed for businesses of all sizes, ensuring seamless compliance

- Eliminates manual efforts with AI-powered automation

There Are Many GRC Products and Vendors, But Risk Cognizance Stands Out

While several GRC platforms exist, Risk Cognizance delivers a powerful AI-integrated GRC solution that meets all the requirements of DORA compliance, risk management, and operational resilience.

1. AI-Integrated Risk Management GRC Product

- Automates real-time risk identification and mitigation

- Ensures continuous compliance monitoring

2. Third-Party Cyber Risk Management

- Provides continuous vendor risk assessments

- Tracks third-party compliance in real time

3. Attack Surface Management

- Identifies vulnerabilities across digital assets

- Provides AI-driven threat intelligence

4. AI-Powered Policy Builder & Syncer

- Automates policy creation, updates, and enforcement

- Ensures organization-wide policy consistency

5. AI Risk Register & AIRisk Syncer

- Centralized AI-powered risk tracking and reporting

- Automates risk prioritization based on severity

6. Ticket Management & Document Management

- Enables efficient tracking and resolution of compliance issues

- Centralizes all compliance documentation in one platform

7. Dark Web Threat Intelligence

- Monitors the dark web for potential data breaches

- Provides early warnings for cybersecurity threats

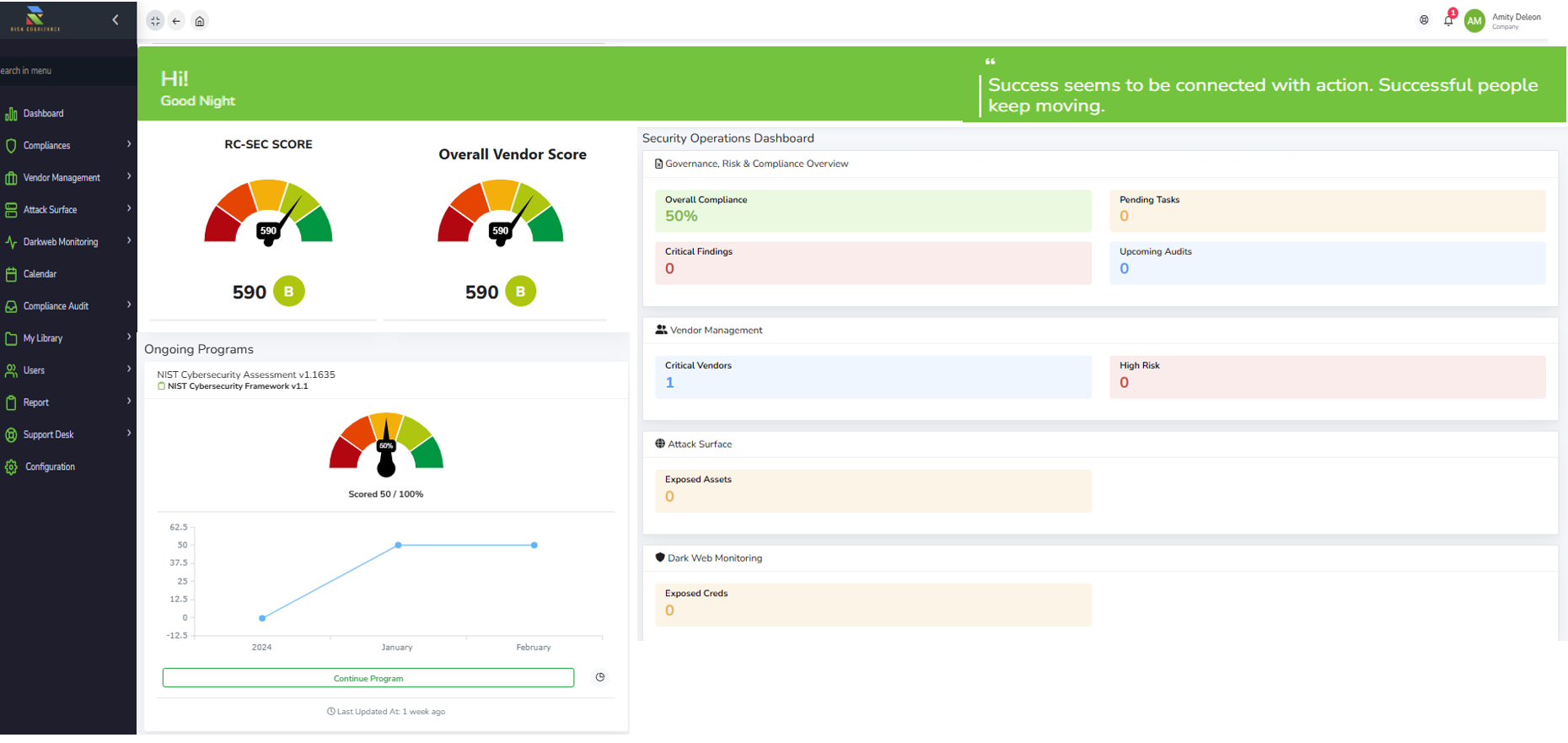

8. Comprehensive Reporting & Dashboards

- Delivers real-time compliance insights

- Generates automated compliance reports for regulators

9. AI-Powered Project Management

- Enhances compliance project execution and tracking

- Ensures on-time completion of regulatory initiatives

Risk Cognizance: The Ultimate DORA Compliance Solution

By leveraging Risk Cognizance’s AI-powered GRC platform, financial institutions and small businesses can simplify DORA compliance, enhance cybersecurity resilience, and mitigate third-party risks efficiently.

.jpeg)