Overview

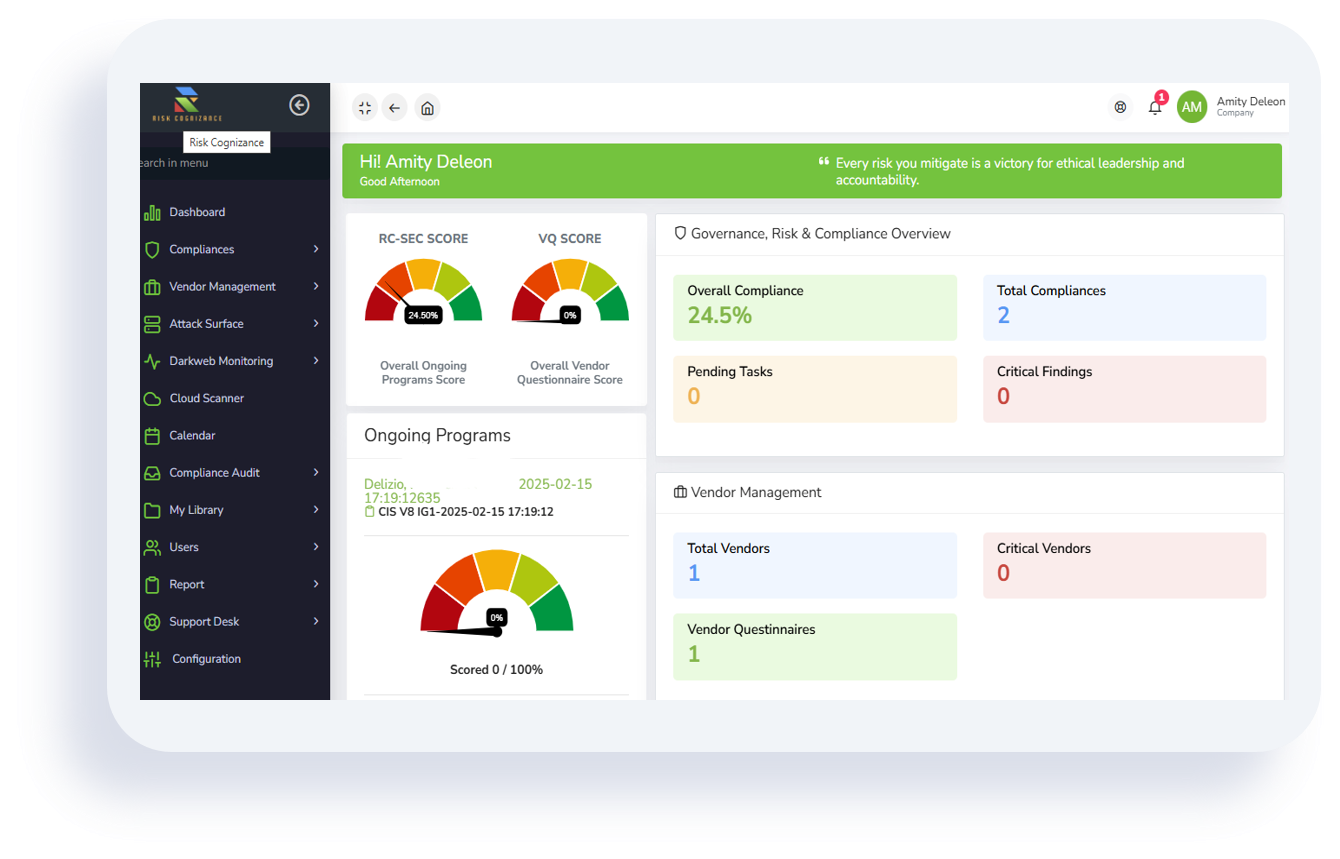

Elevating Enterprise Governance, Risk, and Compliance

Organizations face increasing regulatory complexity, expanding risk environments, and rising expectations from all stakeholders. To adapt effectively, enterprises require a unified approach to governance, risk, and compliance (GRC) that supports operational integrity and strategic decision-making.

Risk Cognizance delivers this critical capability through a connected, AI-enabled GRC software platform designed to unify workflows, increase transparency, and strengthen enterprise resilience.

Our GRC solutions and GRC Suite provide a comprehensive foundation for governance risk and compliance solutions through:

- Integrated Automation: Automating evidence collection and risk scoring.

- Consistent Methodologies: Standardizing risk and control frameworks across the business.

- Cross-Functional Collaboration: Breaking down silos between audit, compliance, and IT security.

- Real-Time Risk Visibility: Providing immediate status updates to executive leadership.

- Scalable Cloud-Native Infrastructure: Supporting rapid growth and evolving business needs.

A Unified Framework for Enterprise Resilience

Risk Cognizance consolidates GRC functions into one environment, enabling organizations to manage compliance, risk, audit, and cybersecurity through a cohesive operating model.

Key capabilities of the GRC software include:

- Centralized Control Management: Single source of truth for all security controls.

- Cross-Framework Mapping and Alignment: Satisfying multiple regulations with a single control implementation.

- AI-Assisted Risk and Compliance Insights: Delivering predictive analysis, not just historical reporting.

- Enterprise-Wide Dashboards and Reporting: Tailored views for executives, managers, and practitioners.

- Integrated Workflow Automation: Streamlining tasks like issue tracking and remediation.

Our GRC platform ensures that leaders gain meaningful visibility while significantly reducing manual workload across the enterprise.

Governance and Policy Management Built for Accountability

Effective governance requires structured, transparent processes. Our policy management software provides robust oversight and standardization across the policy lifecycle.

Organizations benefit from:

- Standardized Policy Creation: Structured templates and approval workflows.

- Automated Employee Attestation Tracking: Ensuring mandatory policy acknowledgment is recorded.

- Policy-to-Control Mapping: Directly linking internal rules to executed security controls.

- Comprehensive Versioning and Audit Trails: Maintaining defensible records of all policy changes.

- Centralized Repository: Providing enterprise-wide access to current policy documentation.

These capabilities elevate governance maturity and support compliance commitments across the organization.

Enterprise Risk Management with Enhanced Insight

Risk Cognizance’s risk management software enables organizations to implement a disciplined and scalable enterprise risk management model supported by automation and advanced analytics.

Key features include:

- Unified Enterprise Risk Register: A single source for all business, operational, and financial risks.

- AI-Driven Risk Scoring: Providing objective, data-backed qualitative and quantitative analysis.

- Integrated Mitigation Planning: Linking risk response directly to control owners and timelines.

- Real-Time Reporting: Delivering concise, relevant data for risk committees and the board.

- Cross-Domain Visibility: Comprehensive oversight across cyber, operational, and business risks.

Enterprise Risk Management

IT Governance & Cybersecurity

Third Party Risk Management

Regulatory Compliance Management

Business Continuity Management

Internal Audit Management

Business Continuity Management

This structure ensures risk programs evolve in strategic alignment with corporate objectives.

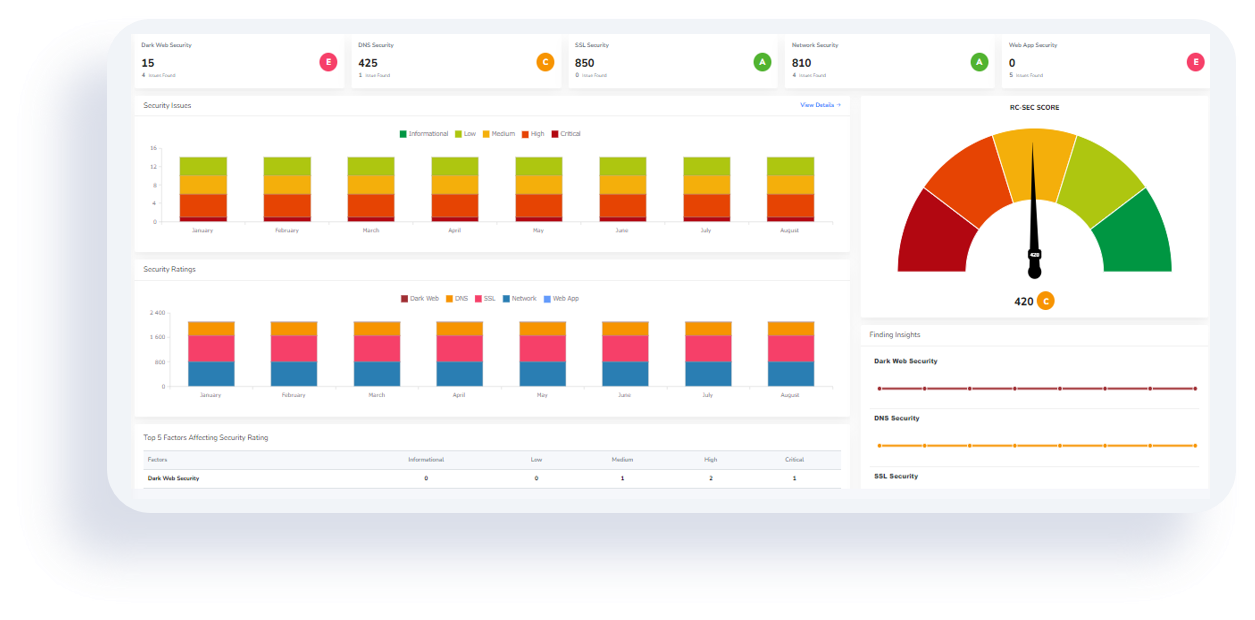

Strengthening Cyber and Operational Resilience

Cybersecurity and operational risk are paramount concerns. Our integrated GRC tool set provides continuous monitoring and structured orchestration across these domains.

The platform enhances resilience through:

- Cyber Risk Scoring and Tracking: Continuous assessment of IT security posture.

- Threat Intelligence Integration: Incorporating external threat data for proactive risk reduction.

- Operational Risk Assessments and Monitoring: Identifying potential failures in critical processes.

- Business Continuity Planning Workflows: Structured planning for disruptive events.

- Scenario Testing and Resilience Modeling: Evaluating the organization’s ability to recover.

By consolidating these risk domains, the GRC platform strengthens enterprise preparedness and response capabilities.

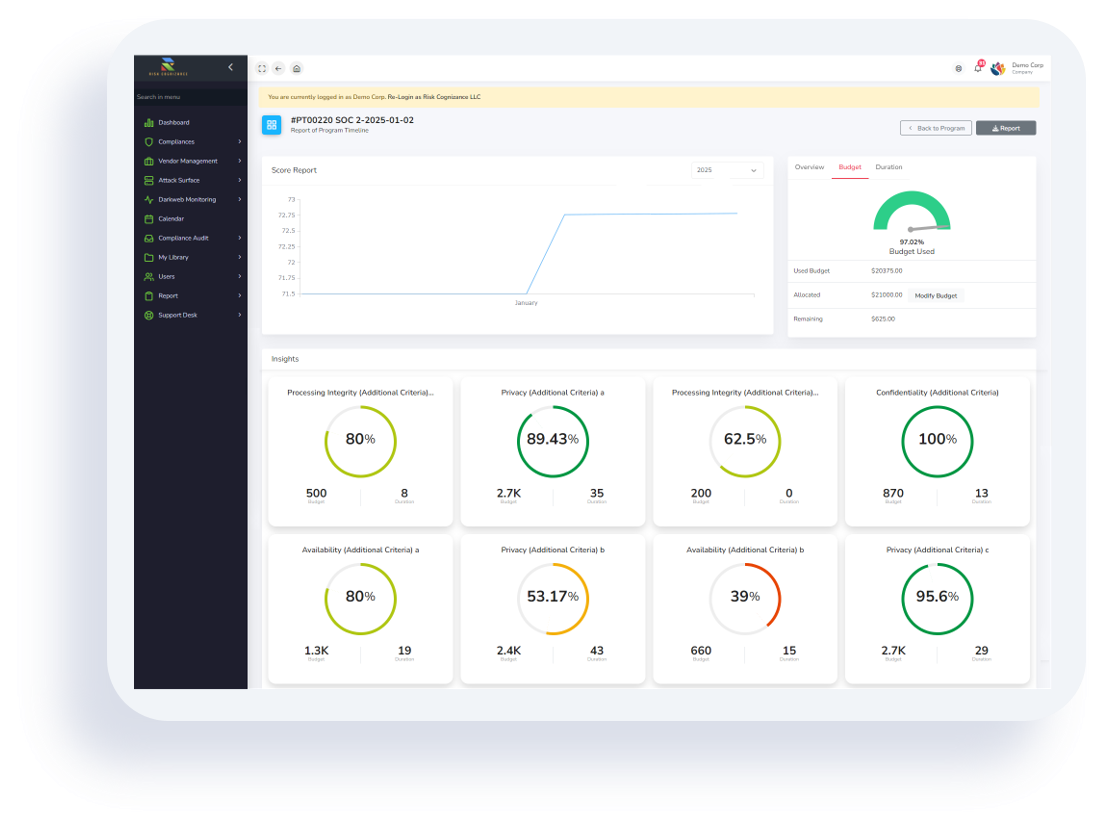

Compliance Management Software for a Rapidly Evolving Regulatory Environment

Regulatory expectations continue to expand across industries. Risk Cognizance’s compliance management software enables organizations to maintain accountability and demonstrate continuous compliance through automation and standardization.

Purpose-built compliance capabilities support:

- SOC 2 compliance software

- ISO 27001 compliance tool

- HIPAA compliance software

- Data privacy compliance software

- Cybersecurity compliance software

- Regulatory compliance software (e.g., GDPR, PCI DSS, DORA, NIS2)

Organizations gain the ability to automate evidence tracking, manage ongoing obligations, and streamline auditor interactions.

Continuous Assurance Through Compliance Tracking Software

Our Compliance Tracking Software supports continuous assurance models through automated control validation and ongoing performance monitoring.

Key features include:

- Automated Control Testing and Alerts: Instant notification of control failures.

- Centralized Evidence Repositories: Secure, auditor-ready storage for documentation.

- Remediation and Exception Management: Structured workflows for managing issues and variances.

- Compliance Dashboards and Analytics: Visualizing current compliance posture by framework.

- Obligation Tracking Across Frameworks: Ensuring no regulatory deadline is missed.

This creates a consistent, repeatable, and defensible compliance program.

Third-Party Risk Management for the Extended Enterprise

Modern organizations rely heavily on external vendors, requiring structured oversight and continuous monitoring. Our third-party risk management software supports a full end-to-end vendor risk lifecycle.

Capabilities include:

- Automated Vendor Onboarding Assessments: Streamlining the initial due diligence process.

- Risk Scoring and Continuous Monitoring: Tracking vendor security status over time.

- Centralized Vendor Documentation: Managing contracts, security reports, and compliance certificates.

- Third-Party Compliance Mapping: Assessing vendor alignment with your internal controls.

- Evidence Collection and Audit Support: Facilitating vendor audit response.

The platform provides visibility into vendor exposure and strengthens supply chain governance.

Internal Audit Software for Comprehensive Evaluation

Effective internal audit functions require a structured approach supported by technology. Our internal audit software provides an integrated environment for audit planning, execution, and reporting.

Core capabilities include:

- Risk-Based Audit Planning: Focusing audit resources on the highest-risk areas.

- Automated Task Assignments: Distributing testing and evidence requests efficiently.

- Integrated Control Testing: Using existing control data for audit validation.

- Remediation Tracking and Escalation: Ensuring findings are addressed promptly.

- Audit-Ready Reporting Dashboards: Providing clear, concise reports for the audit committee.

This integrated approach enhances audit quality and strengthens cross-departmental alignment.

Over 250 Integrated Apps and API access to all of our system.

Automating risk management, with workflow, and our AI compliance management tools.

What are Integrated Risk Management (IRM) Solutions?

Integrated Risk Management (IRM) Solutions provide a unified technology, process, and data approach to identify, assess, mitigate, and monitor strategic, operational, and IT risks across an entire organization, moving beyond siloed management to offer a holistic view for better, faster business decisions and improved resilience. Integrated Risk Management components include combining GRC (Governance, Risk & Compliance), automating workflows, fostering risk-aware cultures, and using dedicated software platforms for real-time insights and streamlined management.

Cloud-Native, AI-Powered, Enterprise-Aligned

Risk Cognizance’s cloud-native architecture supports secure, scalable, and enterprise-ready deployments. As an AI-powered GRC platform, the system adapts to organizational complexity with speed and precision.

Key advantages include:

- Rapid Deployment and Configuration: Accelerating time-to-value for GRC initiatives.

- AI-Assisted Automation: Boosting efficiency across all governance, risk, and compliance workflows.

- Secure, Scalable Cloud Infrastructure: Ensuring reliability and data integrity.

- Extensive Integration Capabilities: Connecting GRC data with existing business systems.

- Unified GRC Operating Model: Establishing consistency across the entire organization.

Advancing Governance, Risk, and Compliance with Confidence

Risk Cognizance delivers a comprehensive and modern GRC Suite that strengthens organizational resilience through structured governance, automated compliance, and integrated risk intelligence.

The platform empowers organizations to:

- Enhance Maturity: Progress from reactive compliance to proactive risk management.

- Improve Operational Performance: Eliminate redundant activities and manual evidence gathering.

- Make Informed Decisions: Rely on real-time data from a unified GRC software platform.

We provide the GRC software platform and governance risk and compliance solutions that support transformation, strengthen oversight, and deliver enterprise-wide clarity.

Recognized as a

GRC Software Leader